In planning ahead for 2022, there are many reasons to be optimistic. After all, there have been trend improvements in the economy and financial markets in 2021, following the painful COVID hit in 2020. Looking ahead to 2022, the COVID-19 pandemic is likely to fade further into the rearview mirror as vaccinations against COVID continue to increase in the year ahead. Fortunately, despite surges in cases of some COVID variants, breakthrough COVID cases (where vaccinated individuals get COVID) have mostly resulted in mild symptoms for vaccinated individuals. This also supports an optimistic outlook for the year ahead.

Despite the economic opportunities and upside in 2022, there are some economic and financial market risks due to high levels of government debt and household debt. Plus, inflation could remain a challenge due to supply chain issues and high commodities demand globally. One of the biggest risks? A return of travel and rise in oil demand. Looking ahead, it is important to keep in mind that peak global oil demand and prices are likely not behind us. They lie ahead. Let’s explore some of these challenges against a backdrop of solid economic and material handling tailwinds and improving post-COVID growth opportunities.

Government debt

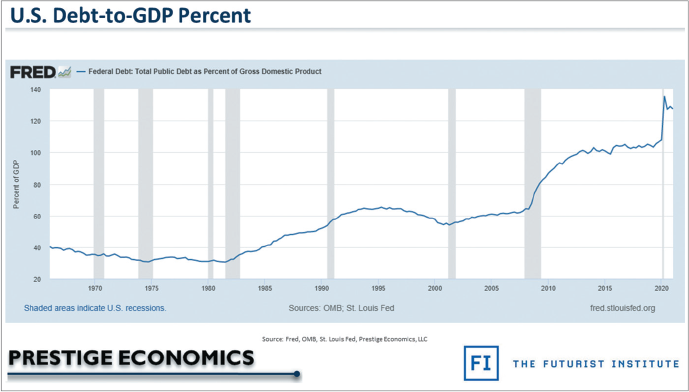

U.S. government debt levels and debt-to-GDP levels increased significantly during the pandemic. The rise in government debt in absolute and debt-to-GDP terms occurred in most countries of the world during 2020 as governments were trying to keep economic growth positive and prevent a complete and total economic and social collapse.

Even though U.S. debt has risen sharply since the outbreak of COVID, the debt-to-GDP ratio has already fallen from peak levels during the pandemic as U.S. GDP growth improved. Looking at the year ahead, there could still be significant policy implications of elevated debt levels in absolute terms, because high debts could further drive the discourse of raising U.S. tax rates.

Household debt

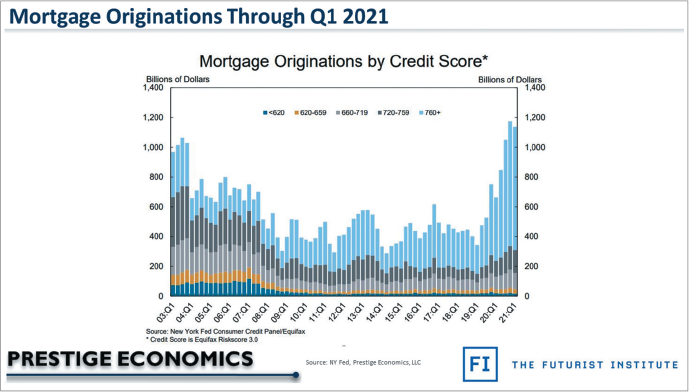

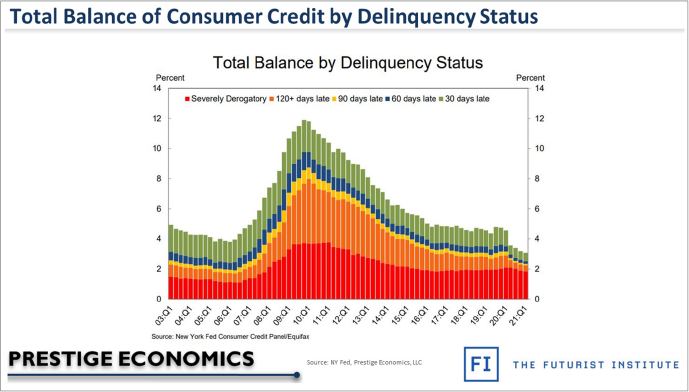

In addition to a rise in U.S. government debt, U.S. household debt also increased during the pandemic to all-time record highs. In my opinion, this is somewhat less of a systemic economic concern, because U.S. household debt-to-GDP ratios have remained significantly below the levels seen prior to the financial crisis and so-called Great Recession of 2007 to 2009. Plus, the health of U.S. credit remains strong because credit quality for mortgages has been much higher than before the financial crisis.

Because of the relatively conservative nature of U.S. new mortgage origination during the COVID pandemic, recession, and recovery, a collapse in the U.S. housing markets seems unlikely. Even the coming rise in interest rates could be less of an issue for mortgage credit and household credit overall because monetary policy is likely to remain relatively loose and delinquency rates are likely to remain low. However, if credit expansion were to grow for lower credit quality homebuyers, then systemic financial, housing, and economic risks would increase. But that has not been the trend since the financial crisis, and it seems unlikely to occur in the year ahead. In general, it seems as if the government, financial institutions, and regulators may have at least learned the lessons of the housing and financial crisis during the Great Recession of 2007 to 2009.

Material handling outlook

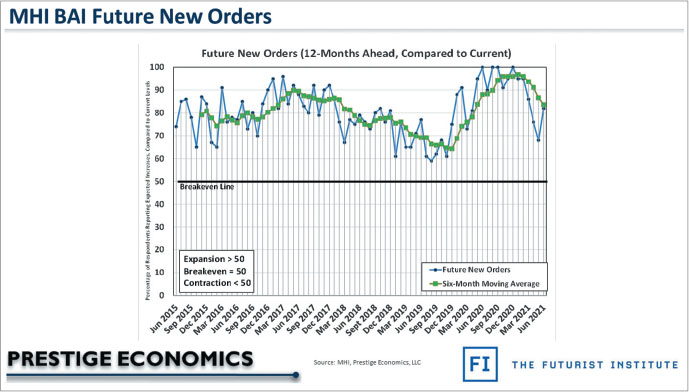

The material handling manufacturing outlook for the year ahead is strong. The MHI Business Activity Index (BAI) has shown strength during the recovery period and the series that reflects new orders for the year ahead (12 months in the future), was exceptionally strong in the second half of 2020 and the early part of 2021. This bodes well for the balance of 2021 actual new orders as well as 2022 new orders.

Supply chain concerns

Some material shortages are likely to dissipate in 2022. However, there are risks that some supply chain problems persist, labor costs remain elevated, and U.S.-Chinese trade relations remain tense. These risks contribute to the potential that inflation rates remain elevated and do not swiftly fall back toward the Fed’s pre-COVID 2% target level. Strong global economic growth and relatively loose monetary policy are also likely to continue supporting demand for physical goods and commodities, like industrial metals. There are even greater upside demand and price risks for oil and petroleum fuel prices.

Oil and petroleum fuel prices in 2022

As global growth, wealth, and population continue to rise—and the world recovers more completely from COVID—oil demand is poised to rise significantly. This is likely to be especially apparent in the summer travel season of 2022. Of course, OPEC+ and U.S. shale oil producers are likely to boost production significantly in the months ahead as prices rise. But some countries already have oil and petroleum inventory levels below pre-COVID levels—at the same time that demand indicators like flying U.S. travelers and vehicle miles driven have still languished somewhat in 2021. So, what will happen when those demand indicators return to pre-COVID levels? The number of miles driven and flying U.S. travelers could reach new highs in 2022 that exceed 2019 levels, engendering a fundamental rise in crude oil and petroleum product prices.

The year ahead is likely to offer significant recovery and growth opportunities. But it’s important not to ignore the risks. Government debt, household debt, inflation, labor costs, material costs, and fuel prices all present challenges. Nevertheless, 2022 is poised to be a solid year for economic growth and material handling industries.

MHI Solutions Improving Supply Chain Performance

MHI Solutions Improving Supply Chain Performance