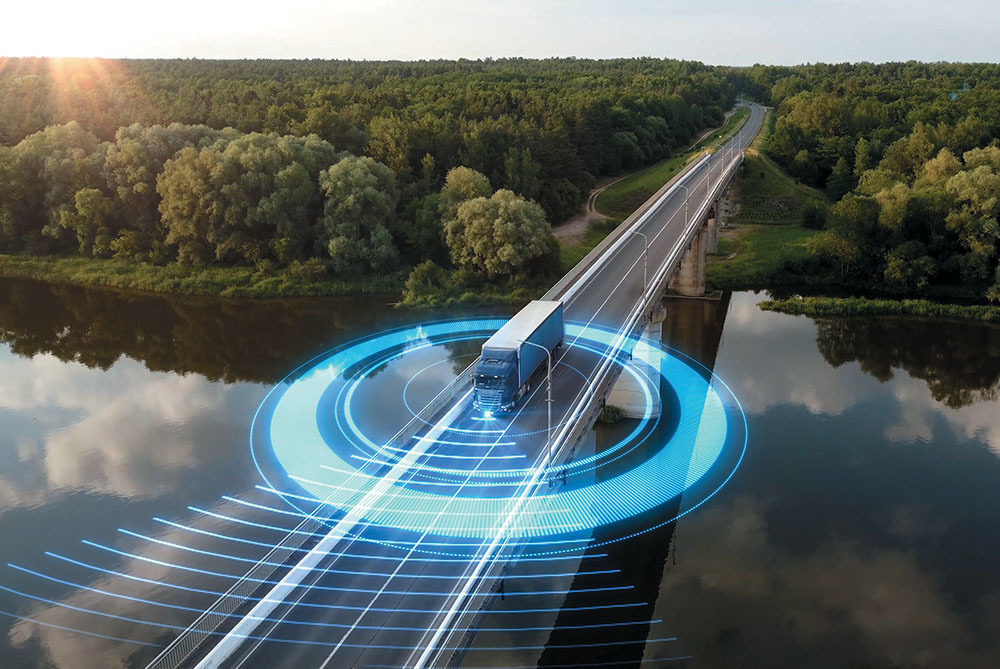

After years in development, autonomous and semi-autonomous vehicles continue to tantalize with their potential to keep supply chains moving in the distribution yard and on the highway. That alluring promise appears closer than ever to being fulfilled, but how humans will figure into the equation remains to be seen.

When MHI member Phantom Auto began developing its remote vehicle operation technology back in 2017, the idea of targeting supply chain applications such as forklifts and yard trucks was the furthest thing from the minds of the company’s founders.

But regulatory and other roadblocks to putting remotely operated vehicles on public roads inspired Phantom to look for opportunities elsewhere, and the supply chain dislocations caused by the COVID-19 pandemic prompted the company to make a direct pivot toward material handling and logistics.

Today, Phantom and other providers of autonomous and semi-autonomous vehicle technology are on the cusp of commercializing solutions to solve first- and middle-mile supply chain inefficiencies, enhance productivity, improve customer satisfaction and reduce the cost of moving goods.

And as the technology rolls out, they say, their products will provide new opportunities for synergies between humans and technology, and rather than simply replacing workers, will create new jobs that are safer and offer improved work-life balance for displaced yard truck drivers and long-haul truckers.

How soon these solutions will be ready for prime time is an open question. Despite advances in artificial intelligence (AI), machine learning, sensors (including AI-enabled cameras), radar and lidar and data-processing capabilities, many have yet to prove they are as safe or efficient as human-operated vehicles.

A Compelling Business Case

One thing that isn’t up for serious debate: The business case for automating the critical first- and middle-mile links in the supply chain has grown more compelling in just a few years due to the boom in e-commerce and change in customer expectations created by the pandemic, as well as other factors:

- Labor shortages throughout the supply chain are still a major pain point as Baby Boomers retire and employers struggle to find workers to fill warehouse jobs or drive long-haul trucks.

- Rising wages have boosted the appeal of fully autonomous vehicles and even vehicles driven by remote operators who can be deployed much more efficiently than drivers tied to one location.

- Efficient asset utilization to keep cargo moving, meet rising customer demands and improve margins is a key focus for logistics providers, and driverless vehicles are a path to that goal.

The number of autonomous and semi-autonomous yard trucks in operation today is small—most are being used in controlled proof-of-concept pilot projects—but is projected to grow at a cumulative annual growth rate of nearly 53% through 2030, according to ABI Research. The installed base of AI-enabled cameras to guide them in the yard will grow to 11.2 million over the same period, ABI predicts.

“Yards surrounding warehouses, distribution centers and manufacturing facilities are becoming the new stomping ground for established supply chain solution providers as they diversify into Yard Management Systems (YMS) and join a growing number of emerging companies focusing on automating yard trailer movements and live asset tracking,” ABI Research analyst Ryan Wiggin wrote in a recent report. “In a bid to digitalize and update yard operations, installments of yard systems, enabling tracking technologies and autonomous tractors are expected to rise considerably in the short to medium term.”

Transforming the Yard

Logistics providers and their supply chain partners will have plenty of choices when yard truck technologies come to market, with remotely operated and fully autonomous systems from Phantom Auto, Outrider, Fernride, Einride and others hoping to make their solutions widely available over the next year or two.

Container terminal operator ConGlobal, for example, plans to expand pilots of its Dynamic Dispatch yard truck leveraging Phantom Auto’s remote operation technology through 2024 and is targeting 2025 for commercialization, said Brett Rogers, VP of advanced solutions for ConGlobal, a Phantom investor.

Outrider, which is focused on fully autonomous yard trucks, announced in December an advance in its AI-driven “perception technology” that allows its trucks to identify fixed and moving objects in the yard. Outrider said the development paves the way for commercial driverless operations beginning this year.

Meanwhile, Fernride planned to scale up pilots of its yard truck featuring “human-assisted autonomy” to 20 trucks by year-end 2023, up from six last June. The company is in pilots with DB Schenker, HHLA and Volkswagen.

Naturally, rivalry in the space has fueled a debate over whose technology—autonomous versus remote—is the best and most cost-effective. While Outrider has publicly dismissed remote operation as “an interesting technology for applications you can’t automate,” the fact is that even Outrider’s autonomous yard trucks have remote backup for scenarios the machine hasn’t learned how to handle.

“We’re not anti-autonomy,” ConGlobal’s Rogers said. “We just don’t believe the technology for autonomy is there yet in a broad generic sense to handle the difficult and always-changing scenarios that we encounter in our operation areas.”

Phantom Auto’s technology enables yard trucks to be operated from anywhere, allowing operators to be decoupled from the production environment and eliminating the problem of finding workers in tight local labor markets. It also allows yard managers to normalize their staffing needs, adding remote operators for peak periods, Rogers said.

The most obvious advantage, of course, is “keeping a human in the loop” at all times the yard truck is operating, using the operator’s ability to understand and react to all situations—with help from an array of safety sensors built into the truck—and communicate with associates on the ground, Rogers said.

Investors are betting the time for driverless yard trucks of all types is at hand. Outrider and Fernride closed significant funding rounds in 2023—raising $73 million and $50 million, respectively—and Phantom raised an undisclosed amount, taking on ConGlobal parent InfraBridge as an equity partner.

Automating the Middle Mile

Not unlike the well-publicized troubles of Tesla, GM Cruise and other autonomous vehicles in the passenger car space, autonomous trucking hit some serious potholes in 2023, as players including Embark, Waymo and TuSimple announced plans to shut down, pause or severely cut back operations.

But others, including Kodiak Robotics, Gatlik, Torc Robotics and Aurora Innovation continue to forge ahead with pilot projects and say they plan to have fully driverless trucks—all now have a “safety driver” in the cab as a backup—rolling on America’s highways in 2024.

With a fleet of about 35 trucks, Kodiak Robotics is currently delivering about 50 loads of freight a week for a range of commercial customers operating 24 hours a day, seven days a week. The company recently opened a new autonomous “lane” carrying freight for Maersk from Houston to Oklahoma City and expects to begin its first driverless runs this year and scale up operations in 2025.

Kodiak is building a “hub-to-hub” model that confines its trucks primarily to interstates and avoids congested urban streets where traffic and variables such as kids chasing balls into the street render autonomous vehicle technology more vulnerable, said Daniel Goff, director of external affairs.

Partnering with truck-stop giant Pilot, Kodiak last year opened its first autonomous “truckport” in Villa Rica, Georgia, for Atlanta-bound trucks coming from Dallas. There, the customer’s local driver drops a Dallas-bound trailer, hooks the Atlanta-bound trailer to his tractor and completes the last-mile delivery.

While the hub-to-hub model acknowledges the limitations of current AI and sensor technology to understand and react to every “oddball” variable, Goff said it shows how Kodiak is taking a pragmatic “safety-first” approach to carve out an appropriate role for autonomous trucks in the supply chain.

“We’re looking forward to building to the point where we’ve built our safety case, which is our documentation, our proof, that our vehicle is safer than a human driver,” Goff said.

Click here to read the full feature.

MHI Solutions Improving Supply Chain Performance

MHI Solutions Improving Supply Chain Performance