Pandemic-era bottlenecks, soaring geopolitical tensions and other factors have ushered in a new era of globalization as manufacturers bring production closer to where their products will be consumed and create lower-cost, more resilient supply chains. South of the U.S. border, Mexico’s nearshoring boom presents a treasure trove of opportunities as demand for material handling and logistics solutions grows.

BY

When Doosan Bobcat announced plans last November to build its first Mexican assembly plant, the material handling equipment maker joined a long and growing list of manufacturers looking to move more of their production capacity closer to the markets they serve.

By the time the new plant opens in 2026 in the northern industrial hub of Monterrey, what began as a wave is expected to be a full-fledged tsunami as U.S. manufacturers, retailers and consumer goods firms make Mexico a key nexus in a transformative retooling of global supply chains.

Seeking to improve speed-to-market, slash inventory and transportation costs, increase visibility and resilience and mitigate geopolitical risks, these companies also are transforming Mexico into a fast-growing market for supply chain solutions providers as new facilities are built and equipped.

The accelerating boom in nearshoring is a big reason Mexico eclipsed China in 2023 as the No. 1 source of U.S. imports, sending more than $475 billion in goods across the border. U.S. imports from Mexico have jumped 38% over the past five years while imports from China plummeted 21%.

And it’s just beginning. Nearshoring over the past three years has been driven primarily by companies with existing operations in Mexico that were able to quickly pull offshore production back when pandemic-related disruptions hit. The next wave will include newcomers like Doosan Bobcat.

“We’re talking about hundreds of new companies that should be coming online in the next couple of years,” said Ed Habe, vice president of Mexico sales for transportation and logistics provider Averitt, which is rapidly expanding its cross-border capabilities. “That’s what I think will definitely be the biggest impact from nearshoring.”

Not Your Granddad’s Nearshoring

Nearshoring by another name has been part of U.S.-Mexico trade since the 1960s, when a handful of U.S. manufacturers—soon followed by foreign companies—set up “maquiladoras,” taking advantage of low-cost labor to make components and finished goods to be exported back into the U.S. duty-free.

Now, after decades of shifting production offshore to Asia or wherever the cheapest labor could be found, more U.S. companies than ever are looking south of the border for solutions to their supply chain woes—and their global competitors are coming, too. Factors driving the new nearshoring boom:

- Crippling production delays and shipping bottlenecks during the pandemic underscored already percolating concerns about overly long and complex supply chains stretching deep into Asia.

- Increasing geopolitical tensions, including fraying U.S. relations with China and Russia’s war with Ukraine, have added new risks to offshoring production and far-flung supply chains.

- Three decades of North American free trade agreements—the USMCA (2020) and its predecessor NAFTA (1994)—have strengthened trade ties binding the U.S., Mexico and Canada.

- Incentive-laden legislation has fueled an “onshoring” boom in U.S. manufacturing that makes Mexico even more compelling for companies looking to shorten and simplify their supply chains.

- The explosion of e-commerce during the pandemic created an unprecedented need for speed in getting products from factory to consumer, putting a premium on geographic proximity.

“Yes, there are some national security threats, there are some potential economic threats because of the situation with China and other factors that are not to be dismissed,” said Frank Jewell, chief revenue officer for MHI member Datex Corp. “But what is truly driving this shift is what consumers want. It’s got to be closer, it’s got to get here faster, because today’s consumer won’t wait.”

Datex is seeing “steady growth” in nearshoring-related demand for its warehouse management system (WMS) technology from both manufacturers and third-party logistics (3PL) providers, Jewell said. At MODEX 2024 in Atlanta in March, Jewell had conversations with two major automakers inquiring about WMS solutions for potential plants in Mexico.

Foreign manufacturing in Mexico has ebbed and flowed over the years with downturns in the U.S. economy and shifts in production to lower-wage countries, but veteran observers like Averitt’s Habe, who opened the company’s El Paso location 24 years ago, says today’s nearshoring boom feels different.

“There’s a definite feel now that not only is it hot again but it’s more permanent and long-term,” Habe said. “I’ve never heard people in Mexico talk 10, 20 years down the line but that’s exactly what they’re saying.”

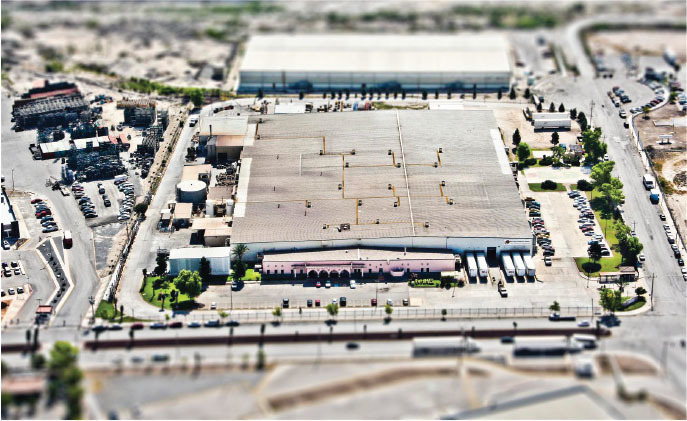

Workers at Hyster-Yale Group’s Ramos Arizpe production facility in northern Mexico. The plant produces forklift components primarily for export to the U.S. and also produces pallet trucks for the global market. PHOTO PROVIDED BY HYSTER-YALE GROUP

Supply Chains Going Regional

What’s happening in Mexico is playing globally, experts say: Instead of choosing manufacturing locations primarily based on labor cost advantages, companies are reconfiguring supply chains in regional networks with parts production, final assembly and end markets closer to each other.

Rob Handfield, founder and executive director of the Supply Chain Resource Cooperative at North Carolina State University, co-authored the 2022 book, “Flow: How the Best Supply Chains Thrive,” which used properties of flow found in nature to explain the shortcomings of far-flung supply chains.

“One principle of flow is around compression—when you bring things closer together, there’s greater flow between those entities,” Handfield said. “We’re starting to see that today, where we’re moving to almost a pan-North American supply chain, where more stuff is starting to be moved to Mexico and shipped into the U.S., and in Europe they’re moving more stuff to Eastern Europe closer to the European markets.”

Doosan Bobcat is a perfect example. The Monterrey facility will allow the company to meet the growing demand for its products in North America while freeing up its Bobcat European production facilities in the Czech Republic to better serve regional markets in Europe, the Middle East and Africa.

“These shorter supply chains will create greater visibility, they’ll allow material to move more quickly, you’ll have better visibility into where it is and you’ll have less of it,” Handfield said. “And less inventory means lower working capital needs and greater cash flow, so that speed is good for everything.”

An Accenture survey of 1,230 engineering, supply, production and operations leaders found that 82% of U.S. companies expect to be sourcing regionally by 2026, up from 50% in 2023, and 85% said they preferred to source parts close to where the end product will be sold.

Hyster-Yale Group, the operating company of MHI members Hyster Company and Yale Lift Truck Technologies, is committed to Mexico as a key part of its regional sourcing strategy, said Tracy Hixson, vice president of global supply chain. The company has made forklift components in Ramos Arizpe in northern Mexico since 2000 and opened a new facility there in 2020 for global production of pallet trucks.

“The objective is to make a very long, potentially unpredictable global supply chain more flexible by moving the complexity closer to our point of use,” Hixson said. “Think (in terms of) standardization of offshored components with high usage but converting these materials to specific model needs such as paint and subassembly in the region of manufacturing plants.”

Jason Schenker, founder and president of Prestige Economics and a consulting economist for MHI, agrees that nearshoring offers benefits in terms of shorter and more visible supply chains, but contends that in the case of North America, the driving force is mitigating the risks of increasingly strained U.S.-China ties.

Case in point: U.S. tech manufacturers are asking their Taiwanese suppliers of servers and other critical components of artificial intelligence (AI) systems to ramp up production in Mexico “as much as possible” to reduce their reliance on China, The Wall Street Journal reported in April.

“I don’t think it’s necessarily regionalization but a geopolitical decoupling of supply chains,” Schenker said. “We’re going to trade more with countries we trust. But we’re going to do a whole lot less business going forward with countries that we’re not in a military, political, trade or economic union with.”

Hyster-Yale Group has had a manufacturing presence in Mexico since 2000 and says it is committed to the country as a key part of its regional sourcing strategy. PHOTO PROVIDED BY HYSTER-YALE GROUP

‘Triple Opportunity’ for Industry?

Nearshoring to Mexico and the continued integration of North American economies under the USMCA presents what Schenker says could be a “triple opportunity” for providers of material handling equipment and technology for factories, warehouses and distribution centers.

Along with more streamlined and secure supply chains of their own and the opportunity to equip other U.S. export-oriented manufacturers, the industry will also see increased demand for material handling solutions from domestic-oriented manufacturers as Mexico’s robust economy continues to grow.

“If our economies continue to integrate, Mexico’s per capita GDP, which has risen massively since NAFTA, will continue to rise,” Schenker said. “That means you’re going to see more material handling demand in Mexico not just for export to the United States but also for domestic consumption as e-commerce and other things become more prevalent with a wealthier population.”

Hyster-Yale Group’s Hixson confirmed the company is “seeing increased opportunity for our products (to be used in facilities making goods for the domestic market) as Mexico moves forward,” but so far has not announced any plans related to possible future expansion in Ramos Arizpe or elsewhere in Mexico.

The opportunity Schenker envisions for material handling isn’t just limited to serving Mexico’s robust consumer and industrial demand. Companies establishing nearshoring operations in Mexico will also be in a position to serve markets throughout Latin America where prospects are ripe for growth in trade.

“They’re looking at Mexico as a means to not only service the U.S. market but also Mexico, South America, the Caribbean and Central America,” said Jose Fernandez, vice president and Mexico country manager for MHI member BlueGrace Logistics, which opened its first logistics center in Mexico in February and hired him to lead a team of 40 at the Guadalajara facility.

As a software provider, Datex hopes to hitch a ride on the coattails of logistics providers expanding southward. Mexico previously had not been a focal point, but the nearshoring boom has led the company to rethink its strategic priorities and now sees opportunities galore south of the border.

“Absolutely,” Jewell said. “We’ve identified both Mexico and a couple of countries in South America as key expansion markets for us.”

Click here to read the full feature.

ISTOCK.COM/ELIF BAYRAKTAR

MHI Solutions Improving Supply Chain Performance

MHI Solutions Improving Supply Chain Performance