Economic Market Analysis

A year of shifting forces

A year of shifting forces

The year ahead is one of significant risk but also opportunity. While backlogs of unfilled orders have been a hindrance to revenue since mid-2020, those same backlogs could help keep manufacturing and material handling activity somewhat buffered from the persistent rise in interest rates and the potential for further slowing global growth. Even a slowdown in the labor market could present opportunities to reduce backlogs and bolster shipments in the face of slowing growth. After all, the labor market has been exceptionally strong, but with the labor market slowing, companies may finally be able to fill empty positions necessary for operations.

Global growth likely to slow

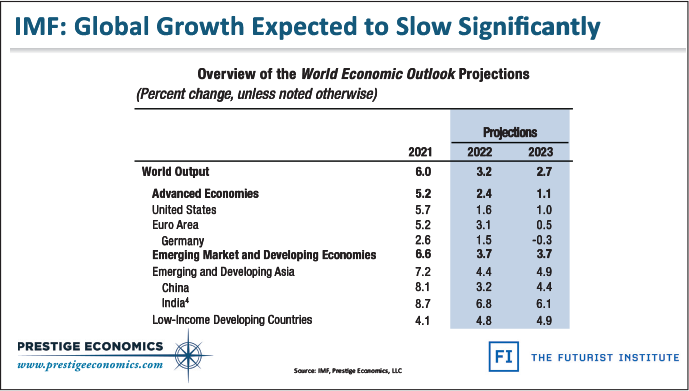

The year ahead also presents rising risks to the global economy. The most recent IMF forecasts of economic growth in the October 2022 World Economic Outlook underscored the potential for slowing GDP growth across economies in 2023 compared to 2022—and especially compared to the growth rates of 2021. After the growthflation of 2021 and the slowflation/stagflation of 2022, what does 2023 hold for the economy, financial markets and material handling?

When assessing global economic activity in the year ahead, the United States and North America appear likely to remain relative bright spots among advanced economies, even as U.S. GDP likely slows further or falls. U.S. growth is likely to remain relatively high, and U.S. growth rates are likely to remain relatively strong compared to other advanced economies. What we call Cold War Two® is playing out on two fronts in Europe and Asia, with effects that are negative for growth yet also supportive of inflation.

In Europe, Russia’s war on Ukraine has ushered in an energy crisis impacting natural gas and electricity supplies, driving up inflation and weighing on growth. In Asia, Chinese ambitions for Taiwan have strained an ongoing trade war with the United States, presenting the significant and rising potential for further supply chain disruptions and military escalation.

Global manufacturing soared in the wake of COVID but began to contract in 2022 as higher interest rates, Cold War Two® and China’s zero COVID policy exacted a heavy toll on supply chains and growth. This is reflected in the aggregate series of the U.S. ISM Manufacturing Index, the Eurozone Manufacturing PMI, and the Chinese Caixin Manufacturing PMI. Looking to the months ahead, global manufacturing may struggle to expand in 2023.

Inflation forces in flux

Consumer prices, manufactured goods prices and employment costs rose in 2021, only to rise further in 2022. Yet inflationary pressures in many categories eased in the latter half of 2022. In 2023, prices may not fall year-on-year, and consumer inflation seems unlikely to slow to the Fed’s pre-COVID and long-term target of 2 percent. But we expect the pace of price increases to slow in 2023, leading to a deceleration in headline and core consumer inflation along with slowing year-on-year rates in other measures of inflation.

TRAVELPIXS/SHUTTERSTOCK.COM

MHI Solutions Improving Supply Chain Performance

MHI Solutions Improving Supply Chain Performance