Feature

The past three years have seen unprecedented changes in supply chains. As documented in the most recent editions of the MHI Annual Industry Report, now in its tenth year of publication, supply chains first sought technologies and solutions that helped bolster resilience in the face of unpredictability.

That was subsequently followed by significant investment in supply chain innovations as C-Suites recognized their ability to generate transformative change and placed greater priority on this critical portion of their businesses. Now, as we enter the post-pandemic phase, companies are beginning to take a closer look at how to harness these supply chain innovations to improve their ability to drive transparency and sustainability.

The 2023 MHI Annual Industry Report, “The Responsible Supply Chain: Transparency, Sustainability, and the Case for Business,” highlights that transition. MHI again produced the industry report in collaboration with Deloitte. All MHI’s Annual Industry Reports, including the newest edition, are free to download at mhi.org/publications/report.

“Responsible supply chains must react in real time to changing conditions. Today’s leaders recognize that this requires actionable data, automation and automated decision-making—and that hinges on building a transparent, connected supply chain,” said John Paxton, CEO of MHI.

Paxton noted the intrinsic relationship between enhancing connections up and down supply chains and the benefits of greater access to critical data.

“Having the solutions that make better uses of that information not only drives timelier decision-making in response to unforeseen events, but also enables improved efficiencies that impact the bottom line as well as reduce a company’s carbon footprint,” he explained.

3RDTIMELUCKYSTUDIO/SHUTTERSTOCK.COM

Technology investment rises

“The report always includes new insights into trends and technologies that are transforming supply chains and the priorities of the people who run them. It also features assessments to help organizations determine their ongoing progress in different areas, and case studies that demonstrate how these innovations are making an impact,” Paxton said.

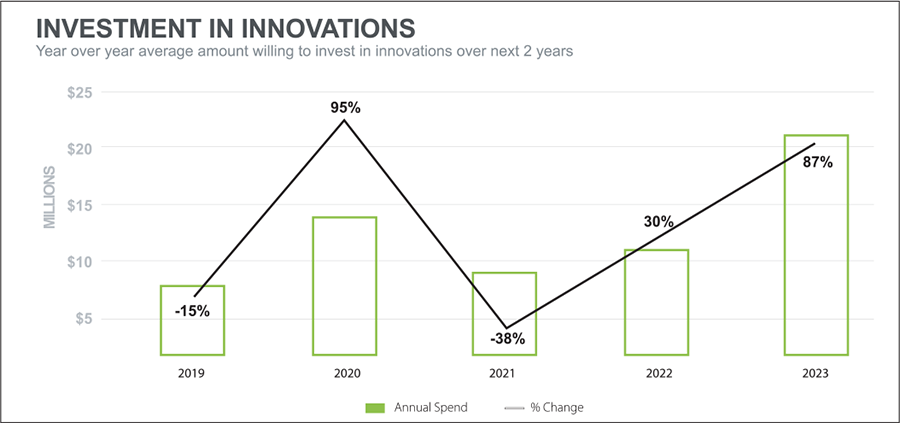

In terms of investment trends, 74% of supply chain leaders plan to increase their supply chain technology and innovation budgets, a 10% increase over the prior year. Further, 90% plan to spend more than $1 million, rising 24% over the 2022 report. Another 36% plan to spend more than $10 million, up 19%. These expanded spending plans accommodate investment in solutions for improved supply chain resiliency, transparency and sustainability—as well as to address the ongoing workforce shortage.

“Investments in automation and in other digital solutions deliver the speed, accuracy and improved visibility that supply chains must leverage for better resilience amid disruption,” Paxton continued. “Now, operations are expanding the application of these solutions to enable the connectivity required to achieve real-time decision-making and transparency. Both are necessary for reporting and improving sustainability and efficiency up and down the supply chain.”

MHI and Deloitte conducted the survey, and more than 2,000 manufacturing and supply chain leaders responded—twice as many participants as in previous years. They represent companies both large and small, with 74% reporting annual sales in excess of $50 million and 8% of $1 billion or more. Titles of CEO, vice president, general manager, department head, manager or engineer are held by 83% of respondents.

“Clearly, people are seeing the value of the report, as shown in the doubling of the participation in the survey this year,” said Paxton. “The report has always been a reliable barometer of supply chain trends; having a larger pool of respondents only makes the findings stronger and even more accurate.”

Technology adoption insights from the 2023 Report

The dramatic uptick in spending forecasts signals an aggressive investment trend, as supply chains increasingly adopt the 11 digital innovations followed by the report over the past decade. These include:

- 3D Printing

- Artificial Intelligence (AI)

- Blockchain

- Cloud Computing and Storage

- Driverless Vehicles and Drones

- Internet of Things (IoT)

- Inventory and Network Optimization

- Predictive Analytics

- Robotics and Automation

- Sensors and Automatic Identification

- Wearable and Mobile Technology

According to this year’s report, all digital solutions surveyed will achieve an adoption rate of 67% or higher over the next five years, led by inventory and network optimization solutions (87%) and cloud computing and storage (86%). That said, respondents expect AI to be the technology with the greatest potential to disrupt the supply chain industry and create lasting competitive advantage. It overtakes robotics and automation, which hovered at the top of the impact race for the past several reports but fell five positions in the 2023 edition.

Wanda Johnson, supply chain and network operations specialist leader at Deloitte Consulting and lead researcher of the report, found the uptick in the percentage of respondents who now consider AI to be the most impactful innovation to be noteworthy. “AI rose four positions, while robotics and automation slid down the list,” she noted.

“To me, this suggests two things,” Johnson continued. “One, that robotics and automation have become table stakes for operations seeking to remain competitive, and two, companies understand that all the data they have collected—and continue to collect—cannot be leveraged without a technology like AI. I anticipate this leading to major transformations for organizations in the upcoming years, as AI allows them to efficiently assess their data to better understand market trends.”

What remains to be seen, continued Johnson, is whether actual implementation levels will match respondents’ projections.

“The top two barriers to adoption reported across all 11 technologies are lack of a clear business case and lack of adequate talent. Workforce challenges continue to plague supply chains, with 57% of survey participants citing hiring and retaining qualified workers as their top supply chain challenge, followed closely by 56% who say the talent shortage is their biggest struggle,” she noted.

MHI Solutions Improving Supply Chain Performance

MHI Solutions Improving Supply Chain Performance